Not Sure Whether Rent to Own is the Best Choice for You?

In this article, we will discuss Rent-to-own providers and how they offer a variety of benefits that can be perfect for your needs. For instance, you can choose the size and style of shed you want, and you won’t have to worry about maintenance or repairs. Plus, you can cancel your agreement at any time without penalty.

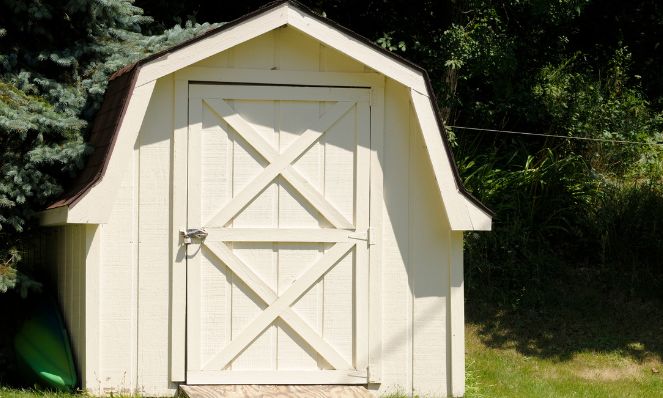

If you’re looking for an affordable way to get a new shed, then rent-to-own could be the perfect solution for you. With this option, you can enjoy all the benefits of having a new shed without having to pay the large upfront costs normally associated with buying a shed.

We understand that there is a lot of information online, and choosing between all the conflicting information can be difficult. That’s why we’ve put together this guide to help you make a more informed decision. In it, we’ll cover everything you need to know about rent-to-own, from how it works to what to look for in a provider. We’ll also provide some top tips on how to get the most out of your rent-to-own agreement. So, if you’re ready to learn more, let’s get started.

What is Rent-to-Own?

Rent-to-own (RTO) is an option many manufacturers and shed dealers offer that allows you to rent a shed for a fixed monthly price. The rental period typically lasts 36, 48, or 60 months, after which you have the option to purchase the shed outright. Rent-to-own can be a great alternative to traditional shed financing options, such as leases, personal loans, or credit cards. With RTO, there’s no need for a large upfront payment, so it’s more affordable for many people. Plus, you’re not tied into a long-term contract like you would be with a traditional loan. This means that you can cancel your rent-to-own agreement at any time without penalty.

What is a Rent-to-Own Provider?

Let’s discuss what an RTO provider is and what that entails. Rent-to-own providers work with different shed manufacturers to help customers rent a wide variety of sheds. This makes it easy to find the perfect shed for your needs. Since it is not financing, there is no credit check or having to worry about qualifying for a loan and their interest rates. It is purely a rental agreement for the shed you choose, with the option to purchase the shed after a predetermined number of payments are made (usually 36, 48, or 60 months).

Why is RTO a Win-Win Solution?

The rent-to-own (RTO) model helps shed builders and buyers come together and find a solution that benefits both sides. The buyers can get a shed without having to wait to save up the cost of a shed. The shed manufacturer can sell its products to more buyers. The majority of renters end up purchasing their buildings. This results in more satisfied customers, which is good for both sides. In a small number of cases, the renter will decide to return their shed to the manufacturer and end the rent-to-own agreement for which there is no penalty for doing so.

Unlike financing and other credit-based purchases like a lease, the customer is not obligated to purchase their shed, and there is no penalty fee or negative report on your credit score to deal with. The rent-to-own agreement between the lender and the renter allows tenants to use their possessions for the duration of the agreement as long as timely payments are made. AFG Rentals even offers Bonus Bucks where you get money back with each on-time payment you make, and that amount is applied the same as cash towards your final payment.

How Do RTO Companies Determine Eligibility if They Don’t Use or Report to the Credit Bureaus?

RTO companies use a variety of methods to determine eligibility. This includes employment verification, bank statements, and other financial information. Some providers may also require that you have a certain amount of equity in your home.

What Are the Benefits of Rent-to-Own?

There are several benefits of rent-to-own agreements. First, it’s a more affordable option than traditional financing. This is because you’re not required to make a large upfront payment. Plus, you’re not tied into a long-term contract like you would be with a traditional loan. This means that you can cancel your rent-to-own agreement at any time without penalty.

Applying rent payments to your principal balance is one of the main benefits of rent-to-own agreements because a portion of your monthly rental payments will go towards the shed’s purchase price. This means that you’ll build up equity in the shed over time. And, if you decide to purchase the shed at the end of the rental period, you’ll have already paid.

What Are the Differences Between Rent-to-Own and Traditional Financing?

The main difference between rent-to-own and traditional financing is that you’re not required to make a large upfront payment with rent-to-own. Another difference is that you’re not tied into a long-term contract like you would be with a traditional loan. This means that you can cancel your rent-to-own agreement at any time without penalty.

What Happens if I Want to End My Rental Agreement?

If you want to end your rental agreement, you can do so at any time without penalty. You will need to return the shed to the provider by calling them and scheduling a time for the retrieval department to come and pick up the shed. Any damage or changes made to the shed will be your responsibility, and payment must be submitted to your dealer or manufacturer when they retrieve the shed.

What Are the Drawbacks of Rent-to-Own?

There are a few potential drawbacks of RTO agreements. First, you may end up paying more for the shed than you would if you had purchased it outright. Additionally, you’ll need to make sure you make all your payments on time. If you don’t, you may be charged late fees, or your rental agreement could be terminated.

RTO agreements can be a great option if you’re looking for an affordable way to purchase a shed. However, there are a few things to keep in mind before you sign on the dotted line. Make sure you understand all of the terms and conditions of your agreement, as well as any potential fees. And, be sure to make all of your payments on time to avoid any penalties.

How Do I Determine How Much Shed I Qualify for?

The amount of shed you qualify for will depend on a variety of factors, including your employment verification, income, bank statements, and other financial information. Some providers may also require that you have a certain amount of equity in your home.

What Are the Differences Between One Rent-to-Own Provider and Another?

There can be a few differentiating factors between RTO providers. These may include the length of the rental period, the amount of the monthly payments, and any additional fees charged by the business. Be sure to compare all of these factors before you choose a provider.

Picking a rent-to-own building is a big decision. But, with a bit of research, you can find the perfect shed for your needs. Be sure to consider all of the factors mentioned above, as well as any others that are important to you. This way, you’ll be sure to choose an RTO provider that’s right for you.

Do All Rent-to-Own Providers Require a Background Check?

Most rent-to-own companies will not ask for an applicant’s criminal history, but some may in order to qualify for their program. Each RTO provider is different, and some will run criminal records and other personal information through various databases before deciding whether or not you’re eligible to rent from them. If this doesn’t work for you, simply find another provider.

What Happens if My Shed is Damaged in a Fire or a Flood?

If your shed is damaged in a fire, flood, or another natural disaster, you will likely be required to purchase a new shed unless you have a loss damage waiver in place. However, this will depend on the terms and conditions of your agreement. Be sure to read over your agreement carefully so that you understand all of the terms and conditions.

What Happens if I Damage My Shed?

If you damage your shed, you may be required to pay for the repairs. However, this will depend on your specific agreement. Be sure to read over your agreement carefully so that you understand all of the terms and conditions.

What is a Loss Damage Waiver?

A loss damage waiver (LDW) is insurance that covers the cost of damages to a rental property. This type of insurance is typically optional and may be offered by your RTO provider. Before you sign your rent-to-own agreement, be sure to read over it carefully. This way, you’ll be sure to understand all of the terms and conditions. And, if you have any questions, ask your provider for clarification. By following these tips, you’ll be sure to find the perfect RTO provider and be on your way to owning your own shed in no time.

What Happens if I Miss Payments for My Rental Agreement?

If you miss payments on your rental agreement, the provider may have the right to terminate the agreement and repossess the item. Make sure to read over your agreement carefully so you understand the terms and conditions of your contract. Rent-to-own providers have the right to enforce the rental agreement and send their retrieval department to collect the shed with whatever modifications it may have.

Key Takeaways

- Rent-to-own (RTO) is an option many manufacturers and shed dealers offer that allows you to rent a shed for a fixed monthly price. The rental period typically lasts 36, 48, or 60 months.

- Since it is not financing, there is no credit check or having to worry about qualifying for a loan or their interest rates. It is purely a rental agreement for the shed you choose.

- RTO companies use a variety of methods to determine eligibility. This includes employment verification, bank statements, and other financial information.

- It’s a more affordable option than traditional financing. This is because you’re not required to make a large upfront payment.

- You’re not tied into a long-term contract like you would be with a traditional loan. This means that you can cancel your rent-to-own agreement at any time without penalty.

- Before you decide to use a rent-to-own provider, make sure you understand the terms and conditions of the agreement. Consider the benefits and drawbacks of using a rent-to-own provider to help you make the best decision for your needs.

Do you have any tips for choosing a rent-to-own provider?

Share them in the comments below!